[Crypto Update] 12 Coins Beating Bitcoin Right Now

Alex Moschina|September 4, 2021

If you’ve been following along, you know that Bitcoin (BTC) is the world’s biggest and most famous cryptocurrency…

Yet it’s hardly the best.

Especially right now.

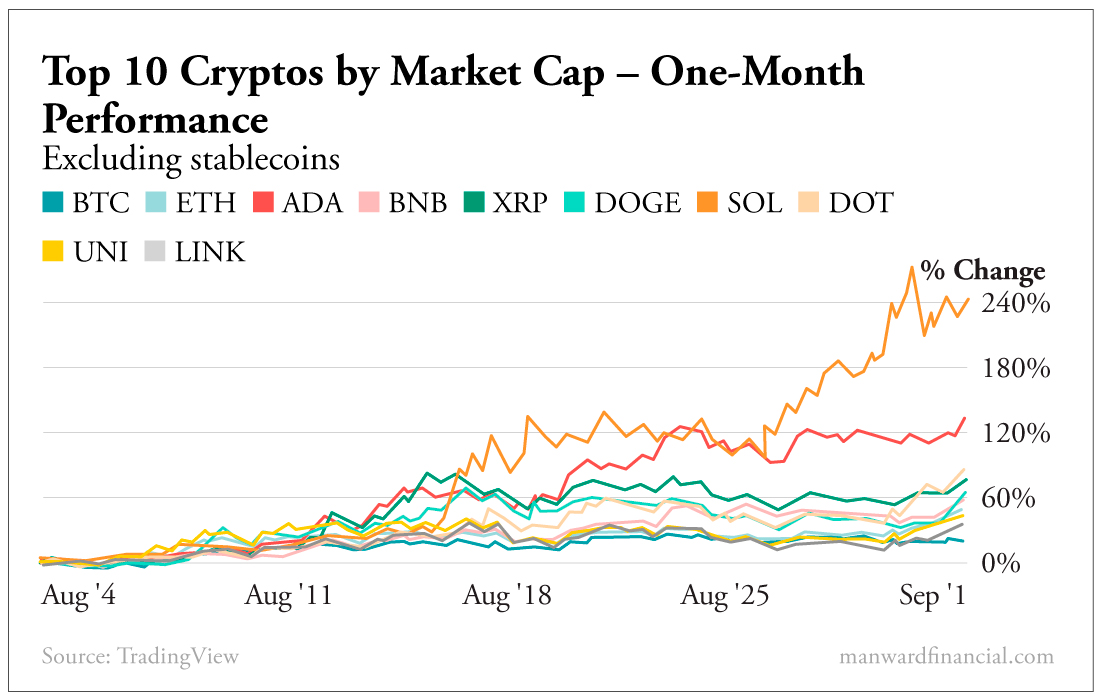

Despite its well-publicized gains over the past month, Bitcoin actually had the lowest return among the top 10 cryptos by market cap.

While Bitcoin was nabbing headlines for its 25% run, Ether (ETH), Polkadot (DOT) and Cardano (ADA) shot up 47%, 78% and 132%, respectively.

Solana (SOL) peaked at more than 270%.

Click here to view larger image

Mind you, these are the biggest cryptos around – the smallest of them is valued at more than $13 billion. Think of them as the “blue chips” of the crypto world.

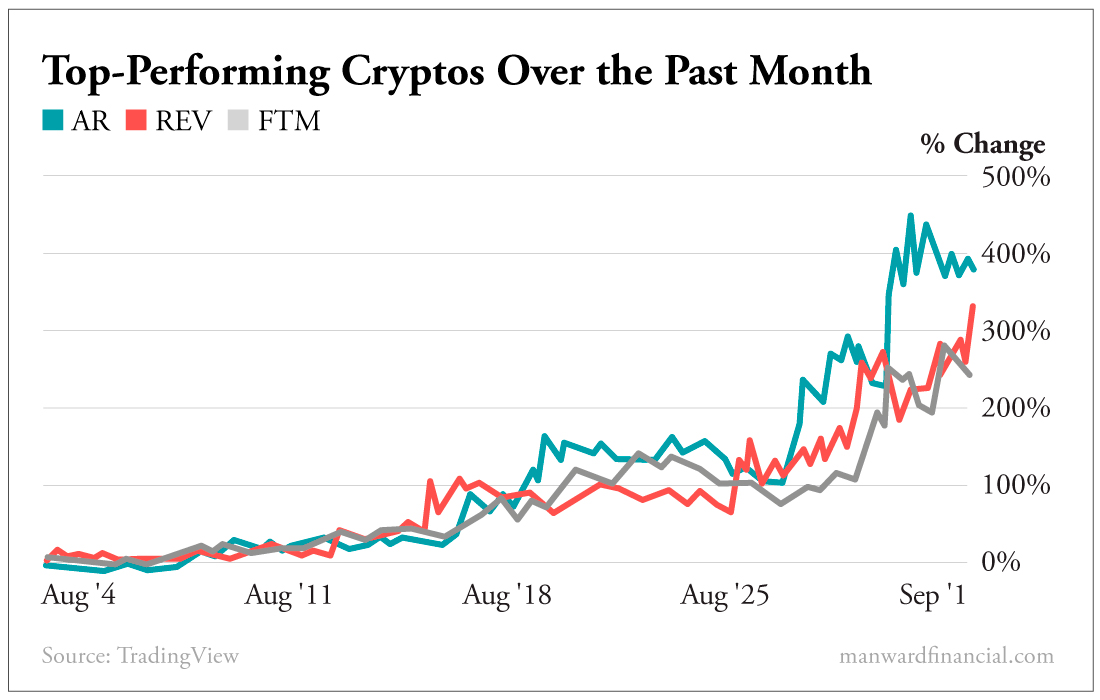

Other coins have done even better…

Lucky Pennies

In fact, the three top-performing cryptos in the world – the “penny stocks” of crypto, if you will, were up as much as 450% in the past 30 days.

Click here to view larger image

Is that proof that cryptos are like stocks? That, as Alpesh Patel recently pointed out, smaller-sized investments often lead to bigger gains?

There’s no shortage of examples to prove the theory… in stocks or in crypto.

But what’s more important to note is: This isn’t a new trend.

Over the past decade, Bitcoin has rarely been among the 10 best-performing cryptos in any given year.

It’s attracted the most money, sure. But its gargantuan size has kept it from providing the sorts of fabled returns investors have come to expect from crypto.

Last year, for example, Bitcoin gained 275%.

But the prize for the biggest full-year gain actually went to a crypto most folks have never heard of – AAVE, which soared 9,500%.

Going Bonkers

We are in the midst of a crypto rally that echoes what’s been happening in stocks since 2009. This excerpt from Fortune sums it up well:

Meanwhile, the U.S. equity markets seem to post records daily. Meme stocks are going bonkers too. Jason Urban, co-head of Galaxy Digital Trading, said when the market’s in a such a risk-on mood, crypto can only benefit…

“Lately, you see people are concerned about inflation, people are concerned about money supply – because of that, historically, people always said buy stocks as a hedge against inflation,” Urban said. Now, he added, it’s crypto as well.

With real interest rates turned negative and free money flowing for the foreseeable future (thanks Mr. Powell), the surge in crypto is sure to continue.

A recent study found that some 46 million Americans have taken a stake in Bitcoin.

It should treat them well.

But as history has shown us… and as we’re seeing right now… there are far greater opportunities out there.

Don’t miss out.

Click here for a sneak peek at Andy’s No. 1 crypto play right now.

Alex Moschina

Alex Moschina is the associate publisher of Manward Press. A gifted writer, editor and financial researcher, Alex’s career in publishing began more than a decade ago when he worked at one of the world’s leading providers of academic research and reference materials. Alex first cut his teeth in the realm of investing when he joined the team at White Cap Research in 2010. There he was charged with covering emerging market trends and investment opportunities. A stint as senior managing editor and editorial director at the prestigious Oxford Club followed. A frequent speaker at conferences and events, Alex has led educational workshops across the U.S. and Canada.