Four Reasons the Dollar Will Keep Falling

Rich Checkan|January 28, 2021

Editor’s Note: As Andy wrote yesterday, the U.S. dollar has had a tough time lately. And today, our good friend Rich Checkan at Asset Strategies International (ASI) takes a deeper look at all the reasons it’s falling… and why it’s sure to continue.

So if you’re looking for a place to put your cash… ASI has been a leader in precious metals and rare U.S., world and ancient coins since 1982. To learn more about ASI and the services it provides, please visit www.assetstrategies.com. You can also call the team at 800.831.0007… or email Rich at rcheckan@assetstrategies.com.

“Something is only worth what someone is willing to pay for it.”

– Publilius Syrus, First Century B.C.

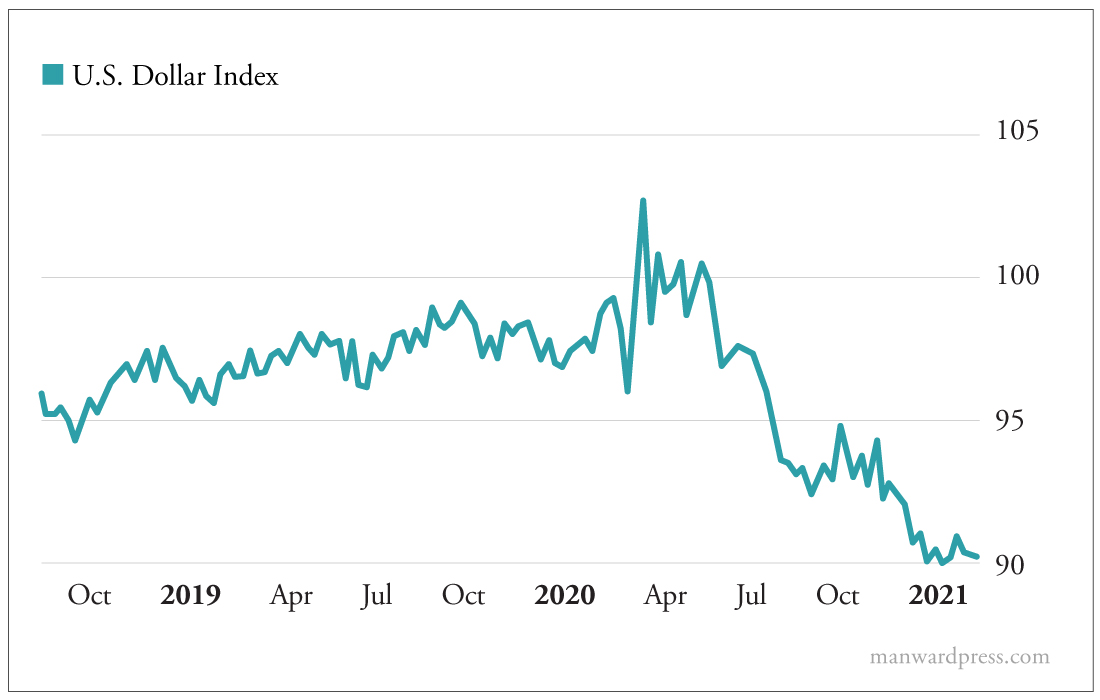

As recently as late March 2020, the U.S. Dollar Index (DXY) spiked as high as 103. But the strength was fleeting. By the end of 2020, the dollar was trading below 90… a nearly 13% fall from grace.

As a reminder, the index is a measure of the relative strength (or weakness) of the U.S. dollar versus a basket of major trading partner currencies. Included in the basket are…

- The euro

- The Japanese yen

- The British pound

- The Canadian dollar

- The Swedish krona

- The Swiss franc

Typically, a reading above 95 means the U.S. dollar is strong. A reading below that means it is weak.

In the chart above, we can see a bearish trend take shape in 2019 as the index stalled when news broke the Fed was once again propping up key markets. The technical downturn was confirmed last year with the break below 95.

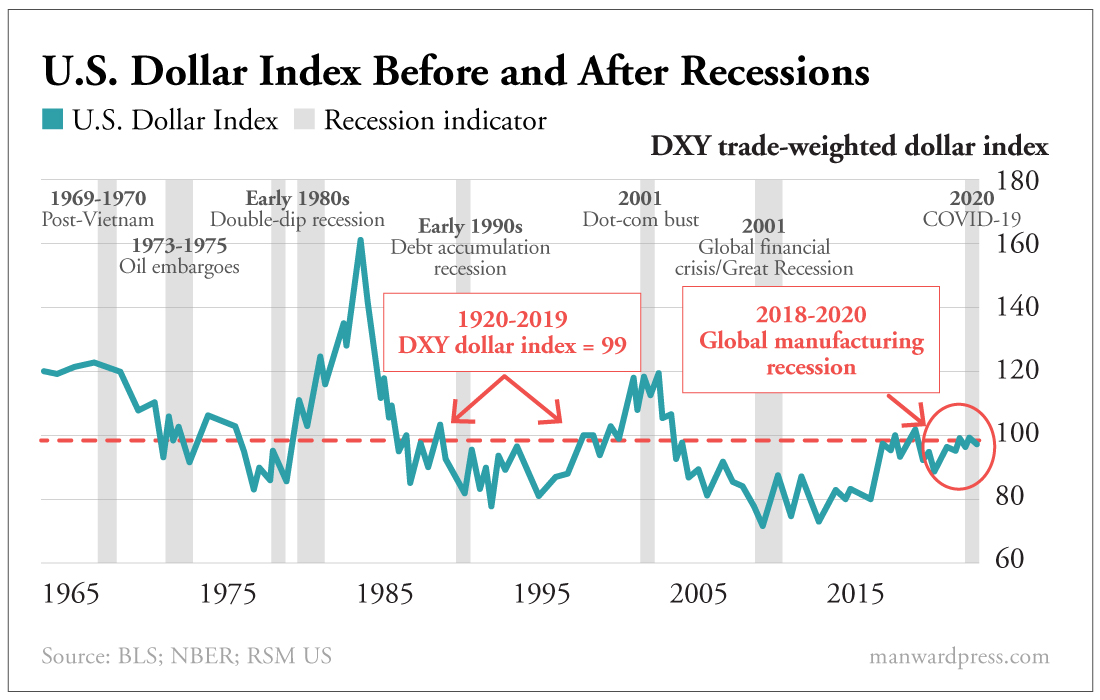

Now, when we zoom out over several decades, we can see that the dollar moves in long-term bullish and bearish cycles.

Notice the length of these cycles. They tend to last roughly seven to nine years.

We’re a little over a year into this bear cycle. And, for a number of reasons, I think the dollar will continue to be worth less for some time.

What Drove the Bull Market?

There were two major drivers of the dollar’s bullish trend and its increasing strength for the better part of a decade.

First, the U.S. dollar was a safe haven. The world had confidence in the way the U.S. navigated the 2007 to 2009 global financial crisis.

Whether you approve of the methods or not, the U.S. took the lead in the global recovery, and that led to more confidence in the U.S. dollar as a store of safety.

Second, coming out of the crisis, the U.S. stock market caught fire.

While mainstream analysts say there was no inflation as a result of the bailouts in 2008 and 2009… I disagree. The stimulus was put in the hands of banks and brokerages. And that cash went into equities or back into the Treasury to earn higher interest on government Treasurys.

Investor greed kicked in, and stocks were driven ever higher… for an unprecedented 10-year bull market in equities. Inflation showed up as elevated stock valuations… where it remains to this day.

Seeing – and seizing – the opportunity… the world’s investors also jumped into the U.S. stock market.

To do so, they needed to convert their currencies to U.S. dollars. This demand fueled the dollar’s strength for a decade.

What’s Driving the Bear?

This new bear market comes from a combination of several factors, all conspiring to take the luster off the dollar trade. Together, they’re pushing the dollar down.

And these factors are driving investors to a couple of strange bedfellows.

Confidence: Whereas the U.S. led the world in the recovery from the global financial crisis, that has not happened with the COVID-19 pandemic.

Lockdowns, joblessness, business closures (in many cases forever) and unclear guidance from governments all served to place doubt in our leadership throughout this crisis.

Monetary expansion: Stimulus flowed into the economy in response to the pandemic. And more is coming. To pay for it, we saw trillions spent… and all of it was printed out of thin air.

To quote Milton Friedman… “Only government can take perfectly good paper, cover it with perfectly good ink and make the combination worthless.”

We saw a 25% increase in the money supply to “pay” for all the stimulus checks, small-business loans and, of course, an array of questionable items like gender studies in Pakistan.

As you know, this unprecedented monetary expansion makes every single dollar in circulation worth less.

Political and social strife: The country is – and is seen by the rest of the world as – divided, pretty much right down the middle. Under President Trump, half the country felt disenfranchised. Under President Biden, half the country feels disenfranchised.

There are social and economic divides as well. As all this plays out for the world to see, it is not surprising that the U.S. looks less like a guiding light and leader for the world than it did a decade ago.

Fear vs. greed: The greed that drove the 10-year bull market in equities was shaken back in March of last year. Yes, the stock exchanges have all recovered and found new all-time highs. But they seem a bit more vulnerable now than they did just a few years ago.

Money Goes Where It Is Treated Best

For all these reasons, the dollar took a back seat to most major currencies last year. And money began to do what it does… flow to where it is treated best.

Last year, that was into Bitcoin (up more than 300% on the year), silver (up 48% on the year) and gold (up 25% on the year).

This makes perfect sense.

The feds have mismanaged the dollar for a very long time. This fiscal irresponsibility already had an impact on confidence in the almighty dollar before the coronavirus wreaked havoc.

The dollar was already on shaky ground with national, state and local governments on the verge of insolvency. COVID-19 and the government reactions to it were the nails in the coffin. There was no political option other than to spend more money that all levels of government don’t have.

As a result, money flowed into alternatives to the dollar in 2020. And I don’t see that trend ending anytime soon.

The people have voted with their wallets. They want alternatives to the U.S. dollar that cannot be mismanaged.

Got gold? Got silver? Got Bitcoin?

You better get some… if you want to keep what’s yours as the dollar continues to lose its luster in a trend that will last for many years.

Are you holding on to cash? Why or why not? Tell us about it at mailbag@manwardpress.com.