FedEx Shows Investors How to Make Money in This Market

Andy Snyder|June 27, 2022

The FedEx driver who delivers to our house is crazy.

Legitimately crazy… as in talking to himself, throwing packages like they’re footballs and, at least once each week, backing down the drive with a fresh dent in the side of his truck.

But the company he works for… it’s anything but crazy.

It’s one of the rare firms putting some jingle into the pockets of investors these days.

We recommended shares of FedEx (FDX) to our Venture Fortunes subscribers a couple of weeks ago. The play is doing quite nicely.

In fact, despite the market’s volatility, shares have gone down on only one day since we got in.

If you tuned in to the company’s earnings call last Thursday evening, you know why.

The numbers are strong.

But unless you were paying very close attention, you may have missed a subtle moneymaking clue. It could be the No. 1 way to make money in times like this.

The company’s CEO used an important phrase several times throughout the discussion.

“Earnings quality,” he said.

That’s important. It doesn’t get enough attention.

Better Profits

Many novice investors simply chase the big money. A dollar is a dollar, they think. One profit stream isn’t any better than the next.

They’re wrong.

Just ask the folks at Netflix (NFLX)… and the hundreds of folks the company just laid off.

Netflix lays out its problem for all to see. It’s right there on the first page of its annual filing with the SEC.

We operate as one operating segment. Our revenues are primarily derived from monthly membership fees for services related to streaming content to our members.

The company gets its sales from one source… memberships.

That’s low-quality revenue.

When times are good, it can create a booming stock. But boy, can things turn bad in a hurry when that income stream suddenly shrinks.

Now… here’s the same section from FedEx’s filings with the investment bosses:

We provide a broad portfolio of transportation, e-commerce, and business services through companies competing collectively, operating collaboratively, and innovating digitally under the respected FedEx brand.

Which company would you rather own when times get tough? Which has a higher-quality stream of revenue?

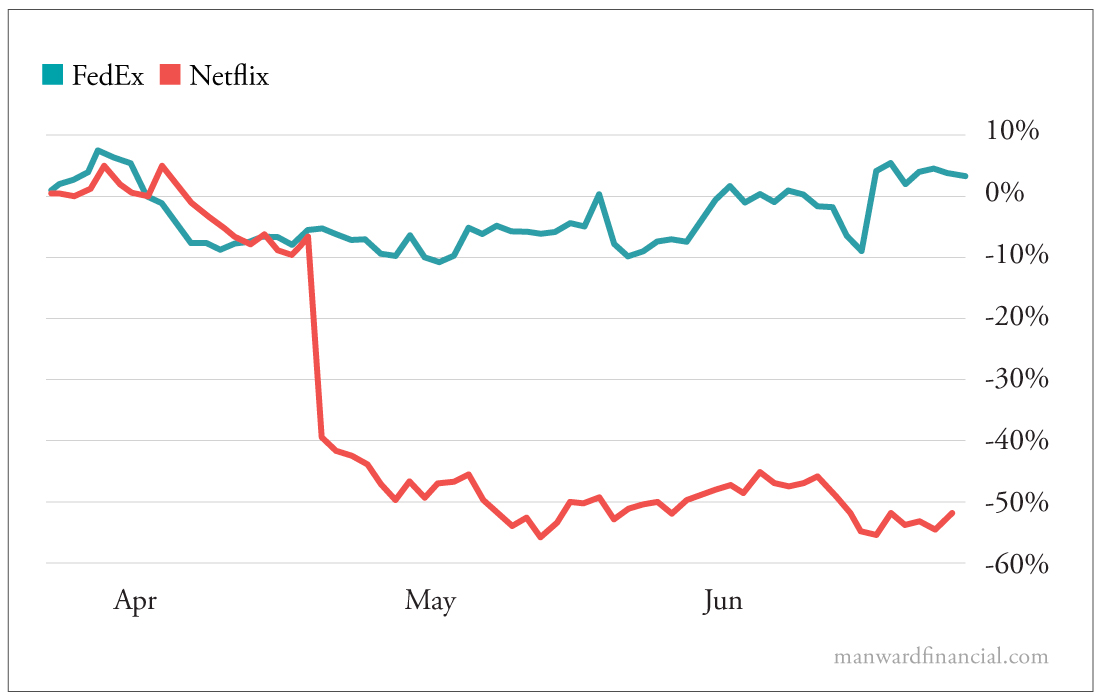

We’ll let the chart do the talking…

Finding companies with quality revenue streams isn’t all that tough. Anybody can do it.

And right now, everybody absolutely should.

Here’s a Checklist

There are three things we look for – sustainability, diversity and predictability.

It sounds like some lefty dogma, but we promise, it’s not. We’ll break it down.

First, we want a sustainable sales stream. If 90% of a company’s sales are coming from just a few key customers… those customers had better be coming back next year, the year after and the year after that.

If not, we want to be 100% sure that there are new customers coming in to take their place.

This is where Netflix has gone wrong. Its customers are shopping around. They’re using one streaming service one month… and moving to another the next month.

The benefit of a diverse revenue stream is quite clear. Netflix has one source of sales. FedEx has ground, freight, express and less-than-truckload operations. The ground business is facing headwinds. The others are not.

That’s the value of diversity.

Finally… predictability. A good way of thinking about this is by asking how much your investment acts like an annuity. Are its sales and profit streams reliable, like an insurance company’s (we sure hope so), or do they come and go on the whims of consumers or the month’s hot trend?

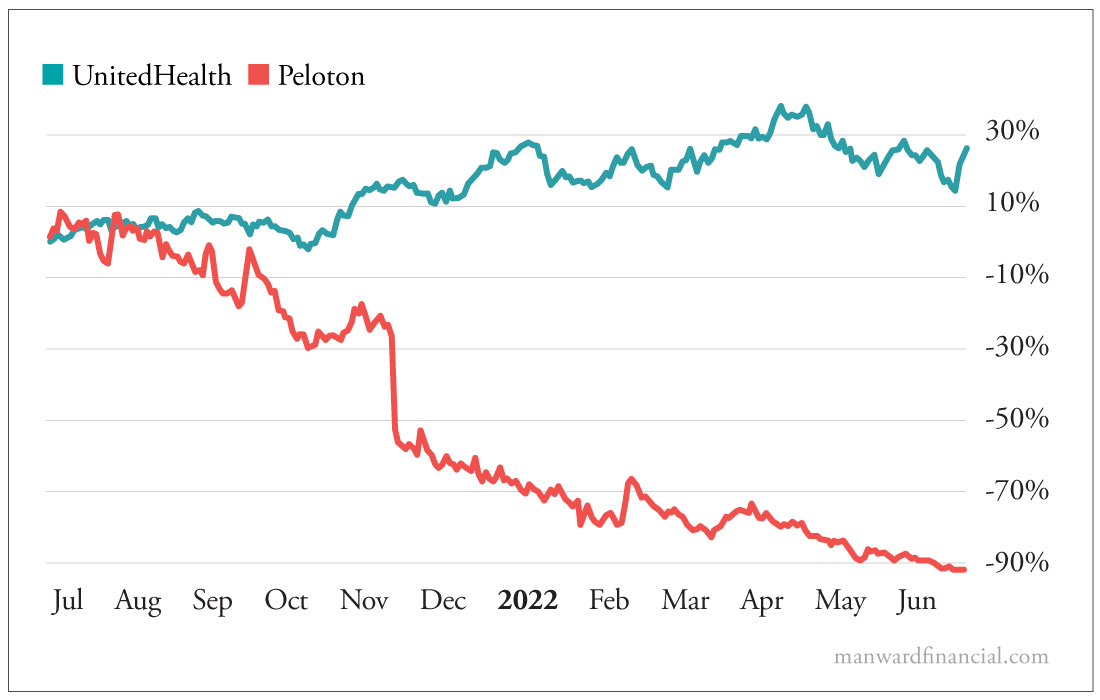

UnitedHealth (UNH) is an example of a company with predictable sales. Peloton (PTON) is not.

Which do you want to own when things go south?

It’s clear that we’re in for a recession. We’ve been saying it for months… perhaps longer than any other analyst in this game.

There are ways to protect yourself.

Better yet, there are ways to make money.

Our stake in FedEx proves it.

Focus on earnings quality.

Find sustainable, predictable and diverse streams of income. When you do, you’ll find a stock you’ll want to own today.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.