How to WIN With Gold

Rich Checkan|June 11, 2021

Editor’s Note: Inflation is ramping up. That means our good friend Rich Checkan of Asset Strategies International is more bullish on gold than ever. His essay below is a must-read for investors who want to know how to protect their wealth as inflation’s bite gets bigger and bigger.

Asset Strategies International has been a leader in precious metals and rare U.S., world and ancient coins since 1982. To learn more about ASI and the services it provides, please visit www.assetstrategies.com. You can also call the team at 800.831.0007… or email Rich at rcheckan@assetstrategies.com.

We are about to celebrate an ominous golden jubilee…

On August 15, 1971, President Nixon stood in front of the American people and did away with the gold standard. His words…

In recent weeks, the speculators have been waging an all-out war on the American dollar. The strength of a nation’s currency is based on the strength of that nation’s economy – and the American economy is by far the strongest in the world. Accordingly, I have directed the Secretary of the Treasury to take the action necessary to defend the dollar against the speculators.

I have directed Secretary Connally to suspend temporarily the convertibility of the American dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States.

It turns out that “temporarily” can mean a very long time… 50 years and counting.

Balanced Checkbooks

To this day, I balance my checkbook.

My parents taught me the importance of monitoring my income and my outgo… and of making sure the latter does not exceed the former. They taught me the importance of honoring my word by paying my bills.

After that fateful day nearly 50 years ago, our government no longer felt bound to balance the nation’s checkbook. Nixon removed the tether – gold-backing – that ensured fiscal responsibility.

Over the next few years, Nixon’s successor, President Gerald Ford, struggled to manage fiscal policy in a world without a gold standard. By October of 1974, consumer price inflation was running at 10% annually. This prompted Ford to deliver his famous “Whip Inflation Now” speech.

Those words turned into a huge media campaign. At the heart of the effort, Americans were encouraged to save more, spend less and, as a result, conquer the specter of inflation.

In the end, the consensus was that the effort was a failure. Inflation averaged a little more than 7% throughout the decade, with double-digit inflation in 1974 and 1979.

Today, as inflationary pressures start to dominate the headlines, I suggest you dispense with the “WIN” buttons and buy gold instead.

Fed-Speak

W.C. Fields famously said, “If you can’t dazzle them with brilliance, baffle them with bulls***.”

From what I can tell, Federal Reserve Chairman Jerome Powell is a big fan of Mr. Fields. The double-talk coming out of the Federal Reserve these days is epic.

Here are a few of my favorites…

- Chairman Powell told us recently that inflationary pressures would be transitory and manageable.

- Treasury Secretary Janet Yellen said one recent morning that they may very well need to raise interest rates to contain inflation.

- Later that same day – after no doubt being chastised for getting off the prescribed talking points – she backtracked, saying there was no need to raise interest rates.

- In the minutes of the most recent Federal Reserve Open Market Committee (FOMC) meeting, it was brought to light that the Fed would need to talk about starting to talk about scaling back the pace of asset purchases sooner rather than later.

If your head is spinning right now, mission accomplished, as far as the Fed is concerned.

Inflation is here. They know it. We know it. They just don’t want you to believe it.

The Fed’s No. 1 mandate is to ensure confidence in the economy and confidence in the U.S. dollar… whether it is warranted or not.

It is not.

Two-Pronged Attack

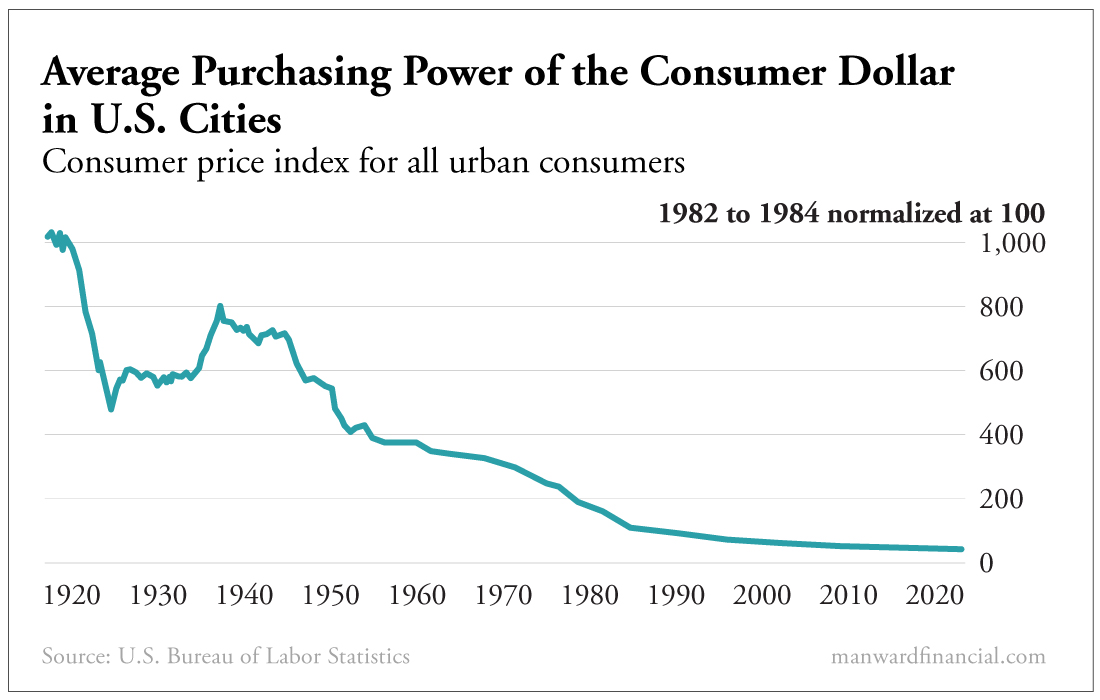

Inflation is coming for your purchasing power in a classic pincer movement. You can feel the pressures closing in from two directions simultaneously…

- Raw materials prices have been surging for more than a year.

- Our money supply has expanded at an unprecedented rate over the past year.

The surge in the prices of raw materials is already having an impact.

Lumber costs alone have caused the average price of a new home to increase by $35,000. Copper prices are at all-time highs. Produce is up more than 6%. Gas at the pumps is up more than 60% from a year ago… and most of that increase occurred before the Colonial Pipeline was hacked.

When raw materials cut this deeply into profit margins for producers of consumable end products, they pass those costs on to consumers by raising prices. It is already happening.

We will see more of it going forward. And it’s going to get much, much worse.

The expansion of the money supply has an impact too.

When you suddenly have a whole lot more dollars chasing a finite number of goods and services, prices are pressured higher. This is Economics 101. A static or diminished supply, combined with increased demand, pushes consumer prices higher.

Prices are rising due to the cost of raw materials… and due to a flood of worthless dollars.

Your purchasing power is dropping significantly.

The Answer

What if there were a way to cryogenically freeze your purchasing power at today’s levels for use in the future?

There is.

What if there were an asset class, in this current everything-bubble economy, that has not bubbled up with the rest?

There is.

What if you could buy it as it starts to break out into the next leg of a long bull market?

You can.

Hands down, gold is the best hedge against inflation. Hands down, gold is the best store of purchasing power. Hands down, gold is your answer.

And gold is on the move again. It consolidated in the first quarter. But over the last month, gold has broken out to more than $1,850 per ounce.

This past week, gold surpassed $1,900 per ounce and is in spitting distance of the previous bull market’s (2001-2011) high of $1,921 per ounce.

If you are looking for a drop in price from here, good luck! With the strength of a consolidation behind it, the bias is for higher prices.

WIN With Gold!

Fifty years ago, then-President Nixon took us off the gold standard.

Since then, weak politicians have chosen spending over restraint. They have chosen debt and deficits over balanced budgets. They have chosen to cast aside the shackles of responsibility and accountability that come with a gold standard.

They have weakened our dollar. They have weakened our economy. They have weakened the nation.

But you can establish your own gold standard. You can strengthen your own portfolio. You can maintain – or even elevate – your standard of living.

Buy gold, and buy it now. There is no better way I know of to Keep What’s Yours!