This Hot Trend Is Just Getting Started: In-the-Know Investors Are Pouring Money Into These Special Pre-IPO Stocks

Andy Snyder

I’ve got my thumb on the hottest investment opportunity of 2021.

How do I know? Because this oddball investment created dozens of billionaires last year… and it’s just getting started.

This is extremely exciting.

Every business owner has dreamed at some point about taking his stake public. The day a company goes public, its founders and early investors get the massive payday they’ve been working for.

Investors, too, dream of getting tangled up in a hot IPO. It’s long been Wall Street’s worst kept secret that getting “pre-IPO” shares almost certainly leads to a big profit when shares go public.

But most folks never have the chance.

Nowhere has the mantra “It takes money to make money” been truer than in the land of IPOs. It takes big money and strong connections to get in before the masses open their wallets and make early investors rich.

But that’s no longer true.

Thanks to what I’m about to detail, you can now get in some of the hottest IPOs of the year with as little as $10.

Proven Results

Take DraftKings (DKNG), for instance. On December 1, 2019, the pre-IPO shares that now represent the company traded for just a bit more than $10 each. At their peak last year – after DraftKings went public – those same shares surged to more than $60 each.

It was a gain of 500% in nine months.

Or look at QuantumScape (QS). Just last August, you could have gotten into pre-IPO shares for $9.89. In December – four months later – shares had rocketed to more than $130 each… a 1,200% gain.

And finally, in another sector that I expect to be red-hot this year, Richard Branson made investors a lot of money when he decided to take advantage of this IPO alternative. On January 7 of last year, the shares that now represent his prized startup Virgin Galactic (SPCE) sold for just $11.36. By February 20 – thanks to the hot market phenomenon I’m about to detail in full – they sold for more than $37.

That’s a surge of 225% in just 44 days.

It’s all thanks to an old trick that’s seeing a massive renaissance.

It’s a capitalist’s delight… a libertarian’s redemption… and an investor’s dream come true.

A Special Investment

The traditional process for taking a company public is exhausting.

It requires reams of paperwork, a lengthy roadshow and intense scrutiny from regulators. It’s an expensive and daunting task.

That’s why, doing what free markets do best, the market has found an alternative. It’s called a special purpose acquisition company, or SPAC.

The way it works is quite simple. Think of it as a publicly traded company that has just one goal… to find the very best privately owned firm and “merge” with it.

It’s a quick and easy way to bring shares of a company to the stock market without all the hassles of a traditional IPO.

You’ll see what I mean and just how lucrative these deals can be over the next year as I get into the details.

Hot Money

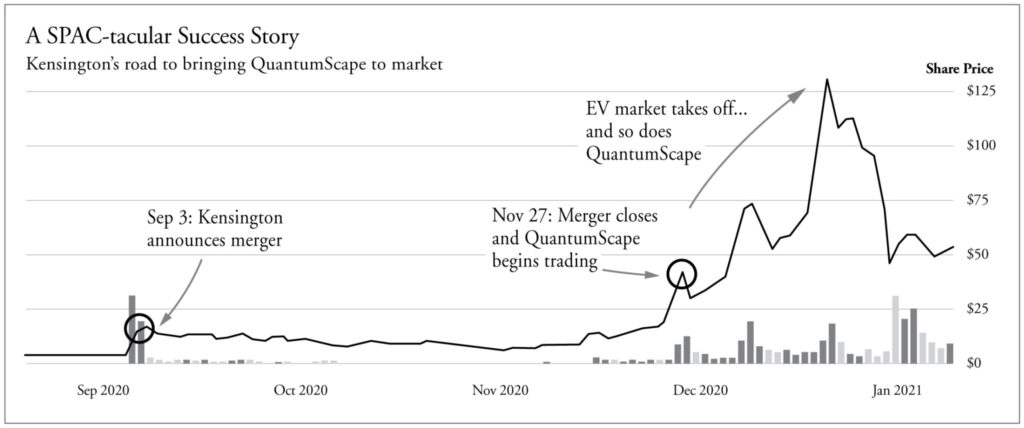

Because the QuantumScape deal made its early investors gains of as much as 1,200% in just a few months, we’ll use it as an example. It paints a good picture… and teaches an important lesson.

In this case, the folks at Kensington Capital were interested in a bit of a moneymaking venture. They figured if they could gather a strong management team and convince enough investors to believe in the team, they could form a SPAC and bring a young startup to its market debut.

They started Kensington Capital Acquisition Corp. It began trading under the ticker symbol KCAC last June.

Like almost all SPACs, it started out trading for just $10 per share. And – again, like all SPACs – it came with a big promise… If the group didn’t find a suitable firm to bring to market within two years, investors would get their $10 per share back.

For the next five months or so, share price didn’t rise all that much. On September 2, shares traded for $10.58.

That meant investors were risking only $0.58… but getting a share that – at minimum – was worth $10. The downside was limited, but the upside was infinite.

It’s no wonder SPACs are becoming wildly popular.

At this early “premerger” stage, investors are speculating only on the strength of the management team. A relatively fresh and unproven team won’t get much of a premium. But experienced teams with strong track records will quickly see the value of their SPACs surge – long before a target company has emerged.

For most SPACs, the exciting action comes when the team announces it’s found a potential merger partner. Often it doesn’t announce the name of the company at first; it just issues a press release that says a deal is in the works.

This step brings attention to the SPAC and tends to get the share price moving.

After that, of course, the SPAC announces what it will be acquiring, as well as the terms of the deal. This is the make-or-break point for early investors.

Going back to our Kensington example, shares of the SPAC doubled during this period – going from just under $10 per share to more than $20.

At first, investors who cashed out on the big, quick win patted themselves on the back. Over the next two months, shares dipped back below $12 each.

But by the time the merger closed and Kensington officially became QuantumScape, shares rose to almost $50 apiece. Within a month – as Tesla (TSLA) soared and rumors that Apple (AAPL) might get into the electric vehicle game spun that market to new highs – shares topped out at $132.

It was an incredible run that proves the potential of investing in these “blank check” companies.

And don’t think all the big gains are done. There will be ample opportunities for triple-digit profits in the year ahead.

Let me tell you about the three ways you can get in on SPACs, and then I’ll share my favorite one for 2021.

Three Ways to Profit

There are three main ways for investors to potentially profit from SPACs – each with its own time frame and level of risk.

The first is the fastest but perhaps least risky – investing in premerger SPACs. A stake in these operationless companies can typically be had for around $10 per share. The money is returned if a deal isn’t done. The biggest risk lies in the management team failing to find a deal or, worse, securing a deal that’s worth less than the equity investors put into the company.

In most instances, that hasn’t been what’s happened. That’s why premerger SPAC investments have been strong moves for speculative investors.

Here’s how it’s done… Find a strong management team with a good history of success and hope history repeats itself.

The second option is actually two options… but both involve news of a merger.

As I mentioned, companies tend to announce a potential deal before they announce its details.

Both announcements create a buying opportunity.

The more speculative opportunity comes sooner… when the company announces it has found a potential partner but has yet to announce the name of the company or the price.

A savvy trader – not an investor – can play the rumor mill for big bucks during this stage.

For the investor a bit more averse to risk, buying a stake after the deal is announced may be a better move. That’s when the market has the details it needs to start making a fair, fundamentals-driven valuation. The name of the company the SPAC will bring to market is released, and so are its financials (including – and this is a big departure from standard IPOs – its projected future revenues).

At this stage, speculation tends to come out of the market and investors can often grab a good deal as volatility drops.

Finally, conservative investors will likely want to take advantage of the third stage of SPACs… when the deal is done and the new company is trading on its own within the secondary market.

At this stage, the newly public company is trading just like any other company, yet volatility remains elevated and any fresh news can send prices moving quickly. It’s like getting into a freshly IPO’d stock, but with a lot less speculation. All the heavy guessing and the strain of a market trying to reach efficiency have already been sorted out.

Because of the efficient nature of SPACs and the massive amount of freshly printed money circulating throughout the global economy, every investor should have exposure to the space. It will be one of the hottest and most discussed asset classes of the year.

Valuations will get rich… and so will savvy investors.

Now here is the one that really catches my eye.

The Door’s Open for This Recent SPAC

Like Uber (UBER) or Tesla (TSLA), it’s a leader in a highly disruptive technology. It’s the result of the hottest SPACs and most respected investment teams. And it’s a play on an inflation-proof sector.

It’s no secret that I’m a fan of real estate these days. In the years after the 2008 crash, there was a shortage of new home supply as builders suffered. Now that shortage is being filled as a flood of Americans rush to the suburbs with cheap money in hand.

Real estate is an ideal investment.

I just bought 4 acres that adjoin a sprawling neighborhood, with plans to buy another 10 acres within the next 60 days.

Real estate’s value doesn’t hinge on the latest headline… the meanderings in Washington… or an upcoming earnings report.

But all that upside comes with a hefty downside. Buying and selling real estate is a slow, expensive process.

I bought my last piece of land without the help of a realtor, and I plan to do the same with the next. It saves thousands if not tens of thousands of dollars.

But while skipping a realtor saves money, it doesn’t always help with the other big downside… time.

A lot of time goes by between when a house first hits the market and when the moving truck finally pulls up.

As I’m writing this, the average time a home spends on the market is 57.5 days. That’s two months. And get this: Even that big figure sits near multiyear lows. Historically, time on market has been closer to 80 days.

Imagine if it took a 6% commission and two months to unload shares of a stock. The market would look a lot different.

And consider perhaps the biggest dealbreaker of them all: the long chain of buying and selling it takes to make a deal happen.

I once sold a house that required three other closings to happen nearly simultaneously for the buyers to be able to get the cash they needed to close on my property. If just one of those deals had gone south, the whole thing would have unraveled.

Altogether, these facts make buying and selling real estate an inefficient and expensive process.

Imagine if there were a company that could fix it.

Imagine if a company could eliminate realtors and their 6% commissions… slash the time it takes to sell a house from months to mere hours… and eradicate all the buying and selling contingencies that make as many as 20% of deals fall apart.

We’d all agree that the company would not only disrupt one of the world’s most valuable and entrenched markets… but also make a boatload of money in the process.

That company exists. And thanks to a recent SPAC… its shares have recently started trading on the open market.

Slow and Expensive… No More

Opendoor Technologies (OPEN) made its stock market debut last June thanks to a SPAC managed by Chamath Palihapitiya – a billionaire business icon.

Palihapitiya’s resume is impressive. He was an early executive at Facebook (FB). He invested in Peter Thiel’s Palantir (PLTR). He had a stake in Playdom… which was bought by Walt Disney (DIS). And he owned a chunk of BumpTop when it was bought by Alphabet (GOOG).

After all that, many folks would have moved to the islands. But not Palihapitiya. He started a venture capital (VC) firm known as Social+Capital Partnership.

That’s where he helped make Slack (WORK), Box (BOX) and Yammer kingpins of the tech industry.

But it’s the ride Palihapitiya started on in 2019 that may ultimately put him in Wall Street’s hall of fame. That’s the year his SPAC, Social Capital Hedosophia, brought Virgin Galactic (SPCE) to the market.

Shares have since tripled in value.

And again, the VC expert didn’t rest after that big win. After Richard Branson and the folks at Virgin cashed Social Capital’s check, Palihapitiya pulled another blank check out of his pocket.

This time he took aim at Opendoor.

Once you know more about the company, you’ll know exactly why the billionaire said this: “These guys are my next 10X idea.”

A Game Changer

Opendoor solves all of the problems I outlined above.

It gives sellers instant cash offers on their homes. That means no more listing hassles… no more open houses… no more realtor headaches… and no more confusing dealmaking. The seller simply enters his address and gets a competitive offer on his home in seconds.

If the seller agrees to the price, he signs a purchase agreement, which jump-starts the next process – an in-person inspection.

From there, it’s a done deal. The seller merely needs to schedule a closing time that works for him.

The process eliminates the biggest hassles of selling a home. But what about buying one?

That’s just as easy… and where the sort of technology I’ve written so much about comes in. Because Opendoor takes possession of homes before selling them, it’s able to show them without the hassle of involving a realtor.

Simply load its app on your phone and drop by any of its homes between 6 a.m. and 9 p.m. Click the “unlock” button in the app on your phone and, boom, the door opens, inviting you to take a self-guided tour.

If you like it, get out your phone again and start making an offer with a few clicks. Buyers can even team up with a local realtor to help guide them through the buying and inspection process.

A First Mover

This sales model is still in its infancy. That’s why I like the potential of this stock so much.

The company was founded in just 2017. But it’s already seeing incredible, industry-rattling success. In 2019, for instance, the company sold 19 million homes, four times that of its nearest competitor. In all, the company saw close to $5 billion in sales.

But here’s the thing… The company is just getting started. Right now, its services are available in just a few cities across 12 states. It operates in a total of just 21 markets. That is just a sliver of the available market share.

The company is aiming to be in 100 markets within a few years… leading to projections of $50 billion in sales.

That’s massive.

The Bottom Line

Of course, sales are one thing… Profits are another.

How does Opendoor make money?

The overall strategy is obvious: buy low, sell high. Just by boosting market efficiency and slashing several middlemen, the company has a leg up on the traditional real estate model. But Opendoor takes it even further.

After buying a home, the company sends in a team of contractors to make repairs, repaint walls and upgrade critical fixtures. And because it’s doing this with nearly 20 million homes each year, it can take advantage of massive scale. Doing some digging, for instance, I found out the company gets an average discount of 40% on its building supplies.

With that sort of scale and ability to undercut its competition, Opendoor is clearly the Amazon of the real estate world.

It’s big… and its scale ensures it will keep getting bigger.

Over the next few years, I expect to see the company expanding its efforts in the realm of mortgages, titles and brokerages. It will ultimately become a behemoth with monopolylike power. Again… see Amazon and what it’s done to the retail industry and the overall economy.

Opendoor has the potential to be a “deflation leader” with the ability to produce a similar impact.

It’s an ideal business to own in a realm of 0% interest rates. When money is virtually free, companies like this can explode in growth.

I suggest you jump in now while the company is still young and most investors don’t yet know what’s about to hit the real estate industry.

World-Class Leadership Opens Doors

Chamath Palihapitiya may be the man responsible for bringing Opendoor to the market, but he’s not the man who runs it. His job is done. But it’s clear that he put his money on a world-class leadership team.

Just look at this pedigree…

The company’s CEO is Eric Wu… He used to be the head of social products at Trulia.

Opendoor’s co-founder and current chief technology officer is Ian Wong, the former head of data science at Square (SQ).

Carrie Wheeler is the company’s chief financial officer. She was formerly a partner at the elite VC firm TPG (TPGY). It specializes in leveraged buyouts and growth capital – perfect for a company in this stage of its lifespan.

The president of the company’s Homes and Services group is a former leader at Amazon and Airbnb. (No wonder the comparisons are obvious.)

And finally, Opendoor’s chief product officer is Tom Willerer, a former vice president of product management for Netflix – a company known for its blockbuster product lineup.

With Opendoor, we’re investing not only in an industry-rattling business model… but also in industry-leading talent.