The Ugly Truth About Easy Money

Andy Snyder|February 1, 2023

Easy is rarely good… or right.

Later today, the markets will be cheering for easy money. At 2:30 p.m., Jay Powell will take the stage in Washington. He’ll say a few words about nothing, tell the world what it already knows and talk about the future of money.

Most folks believe we’ll get a 25-basis-point hike. Money will get more expensive… but hardly.

The more the banking boss hints that money will stay cheap, the higher stocks will go. Markets will pump their fists at any talk of money remaining easy to come by.

It’s a bad idea.

Cheap money is the banker’s version of a tool with a “Made in China” label. It may get the job done once… but it won’t last. Most often, it will end up costing you more than doing the job right the first time.

We don’t need that junk.

Long-term thinkers – the savers and the generationally minded – should pump their fists at the idea of tighter money. Money shouldn’t be easy to come by. Borrowing it should come with a premium. Lenders should think twice about handing over such a precious asset.

When money is cheap… nobody cares where it goes.

It does ugly things to the economy and warps the fate of the folks trapped within it…

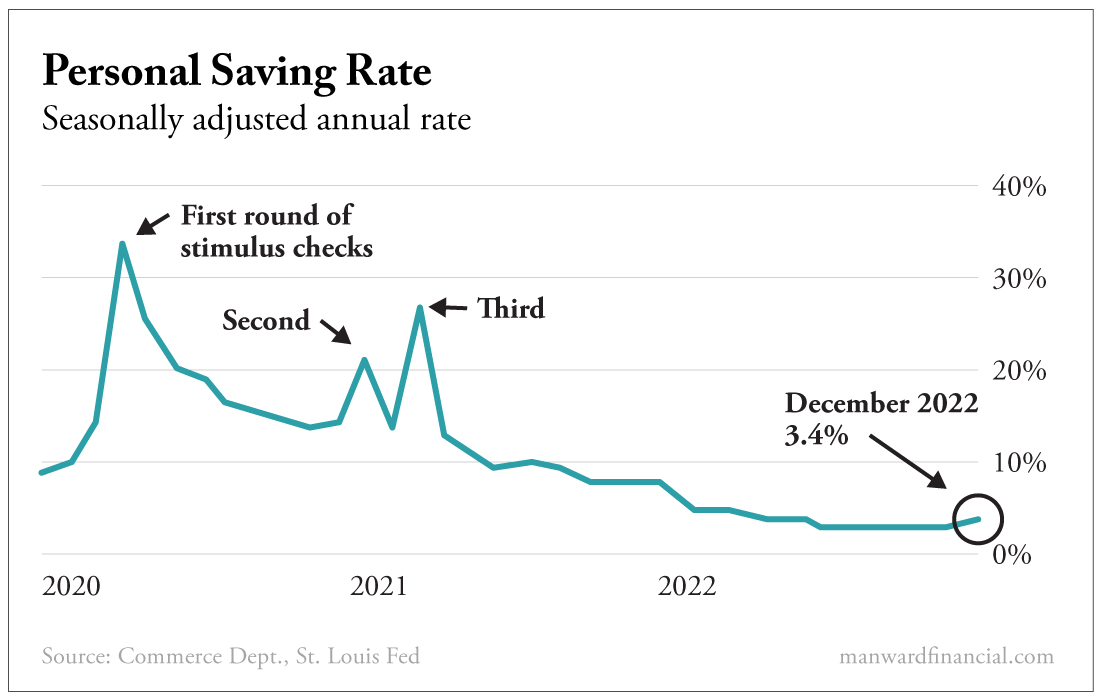

The personal savings rate in America has plunged. Because of rising inflation, more than 7% of folks with an annual income of $50,000 or less can’t afford to pay their monthly bills… let alone save for tomorrow.

Easy money – and three rounds of free money – has immensely distorted the value of things.

Tight money eases inflation. It makes spenders do the math. And it entices folks to save – imagine that.

We can see it in that chart above. Indeed, the savings rate has plunged. But look to the far right of the chart. There’s an uptick. With real rates positive once again, folks have an incentive to save.

The further Jay Powell raises rates… the larger that incentive will be.

We’ve said for nearly a decade now that rates must rise substantially. It’ll be politically painful – like pulling all of the “Made in China” junk off of Walmart’s shelves.

But what a nation we’d be.

Strong money makes a strong economy.

Any other logic is shortsighted and is a threat to our nation and our long-term well-being.

Raise rates. And raise ’em high.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.