Is It Time to Double Down on Bitcoin?

Andy Snyder|January 13, 2022

We hopped on a Zoom call with another crypto expert yesterday. He had just sold a coin for a gain of 18,000% and was quite excited about it.

Very nice.

But our conversation wasn’t about that trade or anything in the past. It was about the future… NFTs (nonfungible tokens), smart contracts, new protocols and even the vast and not-so-far-out possibilities of the metaverse and Web 3.0.

It seems as though each time Bitcoin slips from its highs, the media is ready to write off the entire $2 trillion crypto space… as if the big players behind it were all suddenly going to toss aside billions in investments.

In our discussion with our expert friend, we came to a simple conclusion. The technology behind crypto is getting better and more entrenched with each day. A dip in prices just makes things even more appealing.

For all the folks who said they missed the run to new highs… here’s your second chance.

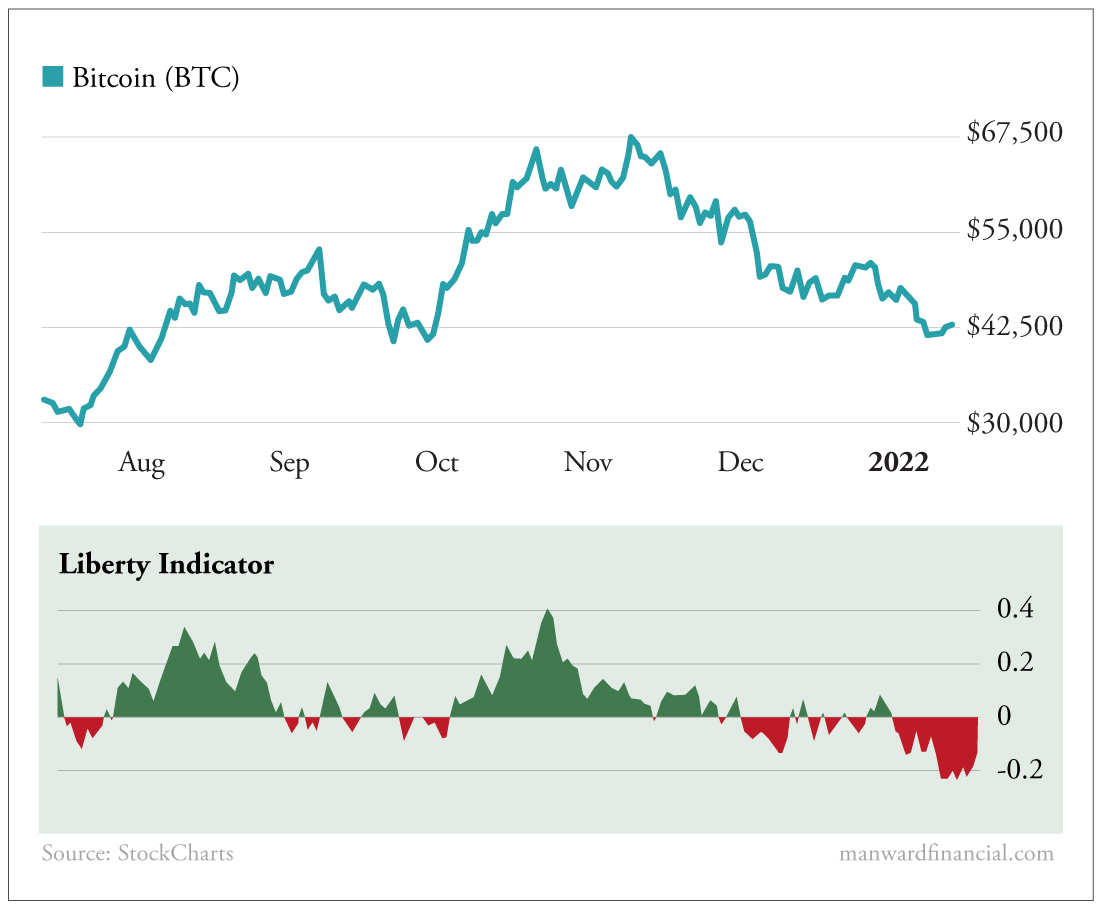

Running Bitcoin through our Liberty Indicator tells the tale.

Out of the Red

Let’s look at the chart…

Starting with the action in August, it’s no surprise that the king of cryptos stretched to new highs in November. The Liberty Indicator – which is the face of a rather dense equation that measures buying and selling volume – crossed from red to green.

It’s a telltale sign of a strong run higher.

Prices surged in September, eventually cooling off as our indicator bounced from green to red and back again several times.

But in early October, we got another strong crossover and history was made.

Since then, the Liberty Indicator has made its deepest run into the red since the market’s crash in March of 2020. Prior to that, we’d have to go back to the fall of 2019 to see sellers outpacing buyers at the clip we saw over the last month.

It’s no surprise.

Powell Pressure

Selling, of course, begets selling… especially in the realm of speculative assets. But it’s Jay Powell and his troops who are truly to blame.

Their expected interest rate hikes will mark the start of a new chapter in the book of crypto. As rates rise, the amount of money going into speculative assets will fall (it’s a storyline we’ll explore a lot in the coming weeks). As we’ve said many times before, Bitcoin and its brethren caught a bid over the last year thanks to ultra-low interest rates and the massive speculation that came with them.

But here’s the thing. As the Fed raises rates from near zero to just above zero, all of that speculation won’t go away. And yet a lot of investors are acting as if it will.

It’s not like we’re going to see rates suddenly rise back to normal. Normal, dear pal, is dead. The virus killed it.

That’s why we’ve likely seen the end of the Fed-sparked sell-off. And now a new and much healthier bullish factor will take over.

We’re seeing it in the chart as the Liberty Indicator looks to have hit its nadir and is headed back to the land of green… and big profits.

The free-money speculation that put crypto on the tip of the nation’s tongue was merely the spark that got the fire lit… the crank that turned the engine over. Now it’s time for cryptos’ technological promise to come to fruition and get things running under cryptos’ own power.

That’s what’s most exciting. And it’s what we talked about yesterday on our call.

The Future of Money

Smart contracts allow real estate to be bought and sold without the expensive hassles common to that market today. NFTs are unique to our homes, cars and other valuables. Stocks can be traded like tokens. Just about any business has a process that would be improved by moving it to the blockchain.

That’s what has us excited… very excited.

The chart tells us we’re not alone. The Liberty Indicator is making a quick surge back to the green for the sector’s big proxy. Once it happens… oh boy, crypto will be back in the news again.

And it will happen for all the right reasons – not artificial pumping by the Fed.

Again, if you thought the market was overheated when Bitcoin was at $67K… here’s your chance.

But it won’t last long.

This chart brings good news.

Be well,

Andy