What’s Next for Your Money in a Growing Nanny State

Andy Snyder|September 14, 2021

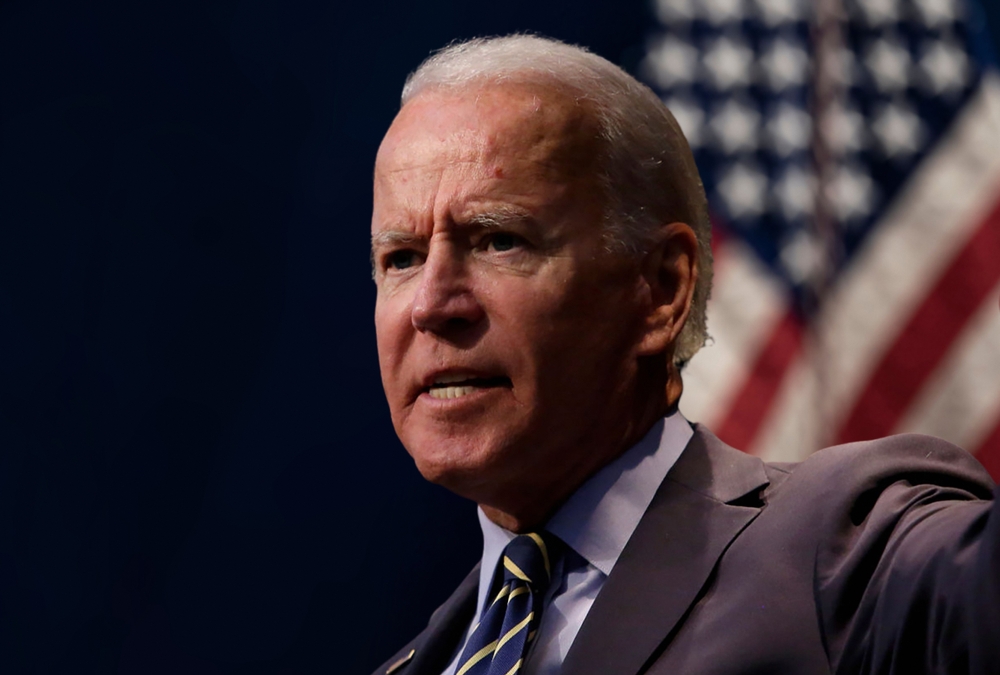

“We’ve been patient,” the president said to the nation’s unvaccinated last week, “but our patience is wearing thin.”

Oh boy.

What’s next, the opposition wonders… Will Biden pull the car over and spank those who are making the most noise? Will he not take us out for ice cream because a few, in his words, are hurting all?

While we promise our words today are about money and not vaccines… we can’t help but use the idea to show that the nanny state has turned into the mommy state.

Folks aren’t making the choices the government wants… so the government is making their choices for them.

“I’ve been patient,” momma says. “But now you don’t have a choice. You’re going to do it my way.”

Red China Leads the Way

For a taste of where this slippery slope heads, we turn our eye to China.

It just said it won’t be approving any new video games anytime soon. That edict comes just weeks after the government told kids they can play games for only three hours each week.

We must have missed the news that China has become one big orphanage. We missed the news that there are no parents within its borders to make their own choices about their children.

According to what we’re reading and the bans Beijing just put in place for its kids (which prohibit any games with “the wrong set of values”), there must not be a single freethinking parent left in the country.

So sad.

What happened to them all?

We’re not sure what sort of biological or ideological pandemic forced the government to step in, but it must be one heck of a plague.

Money Next?

Now, China and the United States are two different countries with two entirely different ways of doing business. But thanks to social media, open borders and the U.S. government getting so big that just about any agency can make its own decree (like using OSHA to launch a vaccine mandate), the void between the two is shrinking.

That scares us.

It brings up a lot of “what ifs.”

What if Washington doesn’t like the way we’re saving or investing?

“We’ve been patient,” the next president might say, “but you’re still investing in those evil oil companies. You’re hurting us all.”

It’s coming.

After all, did you know that adding “sustainable” businesses to a mutual fund is now one of the easiest ways to attract oodles of investor money?

So what if the fund doesn’t actually do what it says it does… as long as the stocks in its portfolio have the “potential” to be sustainable.

Oh my.

Or what if you worked hard and had a strong year at the business you started? “We’ve been patient,” the mommy in charge may say, “but you’re just not donating enough…”

“Your products don’t match our morals…”

“That’s enough money for your church…”

“You need to be saving more…”

Or, dare we say it… “We’ve been patient, but your crypto investments are hurting the dollar.”

Inevitable?

The country – if not the world – has gotten itself into a logjam. Timber cut decades ago has piled up into a tangle that’s impossible to pull apart. It may be a pandemic that plugged a hole and forced the rushing water to spill its banks, but it’s the generations’ worth of unsorted logs that are the real problem.

We’ll step clear of the political side.

We’ll warn of only what’s to come on the monetary side.

In a word, it’s “control.”

It’s why we like crypto so much. It’s why we beg folks to hold their nose and invest as much as they can. And it’s why we – sadly – say that it may be now or never.

Someday soon a leader will take to the podium and talk about your money.

You will not like what they say. But when we push back, the rhetoric will sound familiar.

“Because I’m your mother,” they’ll clap back. “And I said so.”

P.S. A good friend of ours just sat down for a big interview to discuss how skittish investors can take full advantage of one of the biggest bull markets in history. If you’re risk-averse or just want to explore a different way of investing… click this link.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.