Pot Stock Profits: Two Ways to Capitalize on Legal Cannabis TODAY

Andy Snyder

It may be the most powerful natural healing solution on the planet. And though it was kept out of our hands for more than 80 years… Americans are finally getting legal access to the healing power of cannabis.[1]

The medical use of cannabis goes back to as early as 400 A.D. But many people are just starting to realize its potential for protecting and restoring health.[2]

Much of this can likely be traced to its complicated legal history in the Western world.

In 1996, California became the first U.S. state to permit legal medical access to cannabis. Today, medical use is legalized in 33 states.[3]

I predict it’s just a matter of time before every state has a medical program in place.

Eventually, I see cannabis being legalized at the federal level.

But we aren’t there yet.

Progress has been slow. Red tape has stifled research. This has limited the medical community’s understanding of the true potential of cannabis… but not in other countries.

Just look at Israel.

It’s on the front lines of medical innovation when it comes to cannabis. It’s easy to understand why. Experts estimate that the global medical cannabis market is worth some $17 billion a year.

And even that may end up being a conservative estimate.

Investors from across the world, including those in China, have turned to Israel to explore opportunities in the medical cannabis market.

So far, this includes almost 100 startup companies producing cannabis-based medicines.

There are an estimated 46,000 Israeli patients signed up for medical cannabis. And there are thousands more on waiting lists. Experts say conditions like epilepsy, obesity, osteoporosis and chronic pain are being treated effectively with cannabis.[4]

But that may be just scratching the surface.

For instance, one Israeli company has been testing 32 unique strains of cannabis to treat serious diseases like cancer, autism and Parkinson’s.[5] And clinical trials on cannabis for treating dementia are currently underway.[6]

In other words, the healing powers of the cannabis aren’t being preached just by guys in tie-dye shirts anymore. Instead it’s coming from doctors and scientists, the people on the cutting edge of medicine.

This is why I wasn’t shocked to discover that one of the most powerful organizations in Europe was officially breaking its silence. But it’s not just supporting medical cannabis. It’s putting its money into it.

I’m talking about the Church of England.

“For Proper Medicinal Purposes”

The Church of England’s investment portfolios are valued at a reported £8.2 billion ($10.2 billion).

Returns from this fund are used to facilitate growth and “contribute to the common good.” This includes funding mission activities and supporting disadvantaged dioceses with their ministry costs.

In all, their investments allow 12,500 parishes to keep their doors open.[7] And they do it through what they call “ethical and responsible investment.”

A group called the Church Commissioners is responsible for managing the portfolio. Since 2010, it has followed the Principles for Responsible Investment backed by the United Nations. This allows the Church to factor ethical, social and governance issues into its financial decisions.[8]

Edward Mason is the Church Commissioners’ head of responsible investment. And he raised more than a few eyebrows recently when he announced that it would be relaxing a self-imposed ban on investing in medical cannabis.

“We make a distinction between recreational cannabis and medicinal cannabis,” he said. “We are content with it being used for proper medicinal purposes.”[9]

This is a big deal.

For years, it was official policy to exclude all ventures that profit from cannabis. But the tide has shifted. The mountain of evidence supporting the health-protective effects of cannabis continues to grow.

The Church Commissioners invest in a way that is “consistent with Christian values.” It excludes investments on moral and ethical grounds. There’s a strict guideline in place.

The Golden Rule for Cannabis Investing

The Church of England confirms that it won’t invest in companies that earn more than 10% of their revenue from things like tobacco, pornography, gambling and high-interest lending.

I call it the “golden rule.”

In the cannabis arena, that golden rule applies to investing in recreational use.

That means the Church of England won’t invest in a company that makes more than 10% of profits from recreational cannabis sales.

The Church of England will hold medical cannabis companies to the same standards it holds pharmaceutical companies. Mr. Mason confirms it will invest only if it is “properly licensed” and “regulated for medicinal use.”

“We are happy to invest in medicines,” he added.

For the medical cannabis industry, it’s more good news.

Hari Guliani is the COO of Grow Biotech.[10] It’s a leading medical cannabis research and advocacy firm in the U.K. He calls the Church’s decision a “positive milestone” for the sector.

“It shows a huge shift in understanding and perspective on what medical cannabis really is,” he said.

But the potential impact goes beyond the U.K.

Saul Kaye is founder and CEO of Israel-based iCAN. Its mission is to help manage Israel’s growing cannabis ecosystem.

“Having the Church of England open up about cannabis is a great move that lends credence to the whole industry,” he said. “It helps break the stigma around medical cannabis.”

It’s not just about the stigma. Boris Blatnik, CEO of Switzerland-based CBD producer KannaSwiss, says it’s about further validating cannabis as medicine: “The support of the Church of England of plant-derived medicine is a further endorsement of the growing amount of evidence to the effectiveness of medical cannabis.”[11]

Support won’t stop from the Church of England.

Who’s Next?

Many are looking to the Methodist Church. Its central finance board is the next largest church investor in the U.K. It won’t comment on its official position. But that alone is enough to fuel speculation.

The greatest supporter of medical cannabis investing, however, could end up being an unlikely source…

The Catholic Church.

In 2014, Pope Francis called on Christians to rediscover the “precious unity between profit and solidarity.” And the church responded. Catholic institutions with assets to invest have placed parts of their investments aside for a specific cause.

It’s called impact investing. The goal is to make money and do good deeds at the same time. And it’s catching on.

The Catholic Impact Investing Collaborative is just one example. It’s a group of 30 American Catholic institutions. Between them is an estimated $50 billion in assets.[12] This is just one group.

But there’s a problem.

Laying the Foundation

The Vatican Bank made $42.9 million in investment profits in 2019. More than twice the profit reported in 2018.

What happened?

Well, 2018 was a bit of a restructuring year for the Vatican Bank. It reported that it refined the screening process it uses for financial investments. This was to ensure that its investments are “consistent with Catholic ethics… in accordance with the social doctrine of the Church.”

This produced with a major benefit last year.

Because of this restructuring, its tier 1 capital ratio – a measure of a bank’s financial strength – is up. In 2017 it was at 68.3%. But in 2019 it was up to 82.4%. That’s a 20% increase.

In other words, it became stronger financially… and made more money. Keep in mind that the Vatican Bank held assets worth $5.7 billion.

I believe it could be the perfect time for it to follow the Church of England’s lead. It could be only a matter of time before the Vatican Bank starts investing in medical cannabis.

It’s with that in mind that I share the following two strategies to help you turn the healing power of cannabis into a financial blessing for your family.

Pot Stock Profit Secret No. 1: Follow the Golden Rule

I predict the Catholic Church will also follow the golden rule I mentioned earlier. That means it’ll likely invest in cannabis companies that earn less than 10% of their profits from recreational products.

Putting ideology aside… it’s a smart strategy.

While the recreational use of cannabis is seeing wider acceptance worldwide, the biggest advances are being made on the medical front.

Just look at the FDA’s approval of Epidiolex. It was a huge step forward for cannabis.

In its official release, the FDA noted that its approval “serves as a reminder that advancing sound development programs that properly evaluate active ingredients contained in marijuana can lead to important medical therapies.”[14]

Amen.

If you scour the Nasdaq, you’ll find numerous biotechs working to develop cannabis-based treatments and therapies. Some of the more well known include:

- Arena Pharmaceuticals (ARNA)

- Cronos Group (CRON)

- GW Pharmaceuticals (GWPH) – the company behind Epidiolex.

Active traders could have collected some truly massive – we’re talking triple- and even quadruple-digit – gains in the sector.

But it wouldn’t likely have been without some casualties.

Still, the overall trend is clear. Following the golden rule works…

Which is why more risk-averse, buy-and-hold investors should consider the Horizons Marijuana Life Sciences Index ETF (TOR: HMMJ).

This unique fund – which is based in Canada and trades on the Toronto Stock Exchange – seeks to replicate the returns of the North American Medical Marijuana Index.

Its holdings include both Cronos and GW Pharmaceuticals, as well as big names like Tilray (Nasdaq: TLRY), Aurora Cannabis (NYSE: ACB) and Charlotte’s Web Holdings (OTC: CWBHF). In all, the fund contains approximately 60 holdings.

Over the past 24 months, it’s seen peaks as high as 142%… 150%… and even 174%.

But that just goes to show you how volatile the medical marijuana sector has been. Horizons Marijuana Life Sciences has a beta of .658, meaning it is about 34% less volatile than the S&P 500.

So if you’re looking for a less volatile entry point in the cannabis-investing space, the Horizons Marijuana Life Sciences Index ETF could do the trick.

It even offers a huge dividend yield (most recently 12.54%).

So, as you can see, it literally pays to abide by the golden rule.

Pot Stock Profit Secret No. 2: Get Your Gains From the Growers

Another smart and profitable way to invest in cannabis is to invest in the land beneath it.

Remember… cannabis is a crop. It needs just the right conditions – and plenty of room – to prosper.

That’s created a huge opportunity for landowners.

It’s the reason I recently plunked down half a million dollars of my own money to buy 32 acres of pristine farmland.

It’s a bet I’m convinced will pay handsomely.

But you don’t need to follow in my exact footsteps to profit. I realize not everyone has the time, energy or resources to go out and buy land suitable for cultivating cannabis.

Instead, why not leave it to the professionals?

You can simply sit back and “collect rent checks” if you pick up a few shares of Innovative Industrial Properties (NYSE: IIPR).

It’s the first U.S.-listed real estate investment trust (REIT) dedicated to serving cannabis growers.

To put it lightly… business is booming.

Starting with just a handful of properties in 2016, Innovative Industrial Properties has expanded its portfolio to include 61 specialized industrial and greenhouse buildings.

The company now leases to state-licensed, medical-use cannabis growers in 16 states, including Arizona, California, Colorado, Illinois, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New York, Ohio and Pennsylvania.[15]

As demand increases, so will the need for facilities like the ones Innovative Industrial Properties offers.

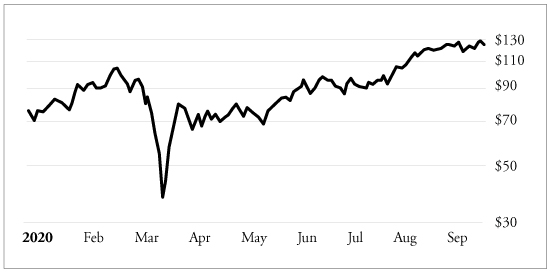

Wall Street has already homed in on the trend. Over the past six months, the stock has shot up more than 108%.

But this is only the beginning.

Really, there’s no telling how high Innovative Industrial Properties can go. And the fact that it doubles as a solid income play makes it a perfect buy-and-hold position.

Most investors know REITs for their strong income-generating abilities. Innovative Industrial Properties is no exception.

The company currently offers a 3.65% dividend yield to investors. And it’s been growing that yield steadily for the past 12 months.

That’s right in line with what other financial services companies are offering – but it’s downright impressive in the cannabis space, where free cash is far scarcer.

“We’re the only cannabis company that’s regularly paying a good dividend,” President and CEO Paul Smithers recently told Barron’s.[16]

That makes Innovative Industrial Properties another great way to play the rapid adoption of medical cannabis – and get paid along the way.

A Natural Solution for Health and Wealth

There’s no disputing the potential of cannabis for protecting your good health. But it may also present a unique opportunity to secure your family’s financial health, perhaps for years to come.

That’s why I recommend following the lead of the Church of England when it comes to investing in this natural health miracle.

With what seems like nonstop innovations and breakthroughs on the medical end, you don’t have to gamble on what could happen with recreational cannabis. The medical sector offers ample opportunity for what I believe could be “like clockwork” profits.

And by investing in the land itself, not just the crop, you can virtually guarantee steady gains as medical cannabis continues to build momentum and helps fix America’s ailing health.

[1] https://www.prnewswire.com/news-releases/medical-marijuana-inc-celebrates-end-of-80-year-ban-on-domestic-hemp-crop-with-passage-of-2018-us-farm-bill-300770012.html

[2] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5312634/

[3] https://www.businessinsider.com/legal-marijuana-states-2018-1

[4] https://www.latimes.com/nation/la-fg-israel-cannabis-medical-marijuana-20190529-story.html

[5] https://www.forbes.com/sites/julieweed/2019/02/03/tested-with-20000-patients-israeli-medical-cannabis-comes-to-the-united-states/#4de408f46d7e

[6] https://www.forbes.com/sites/abbierosner/2019/03/04/new-medical-cannabis-research-from-israel-older-adults-dementia-and-dialysis/#4ed418223660

[7] https://www.churchofengland.org/sites/default/files/2019-05/Church%20Commissioners%20Annual%20Report%202018.pdf

[8] https://www.churchofengland.org/about/leadership-and-governance/church-commissioners-england/how-we-invest/responsible-investment-1

[9] https://www.ft.com/content/297f3234-88fa-11e9-97ea-05ac2431f453

[10] https://growbiotech.com/

[11] https://www.forbes.com/sites/javierhasse/2019/06/13/the-church-of-englands-10-5b-fund-will-now-invest-cannabis/#c706a6c17fd6

[12] https://www.economist.com/finance-and-economics/2017/08/19/the-catholic-church-becomes-an-impact-investor

[13] https://cruxnow.com/vatican/2019/06/11/vatican-bank-reports-decreased-profits-in-2018/

[14] https://www.fda.gov/news-events/press-announcements/fda-approves-first-drug-comprised-active-ingredient-derived-marijuana-treat-rare-severe-forms

[15] http://innovativeindustrialproperties.com/iip-our-portfolio/

[16] https://www.barrons.com/articles/unique-reit-soars-by-backing-marijuana-properties-51553158800