Put This Little-Known Inflation-Busting Strategy to Work

Andy Snyder|July 16, 2021

Worried about inflation?

Like us, do you think Jay Powell is downplaying rising prices for the same reason Fauci initially downplayed COVID-19 and mask-wearing… because he doesn’t want to incite panic?

If so… here’s an inflation-busting strategy that few folks are talking about.

It helps to ensure your income rises along with prices.

You see, for more than a decade now, we’ve been living in an altered state of reality. Thanks to QE Infinity, the economy has been given one hit of adrenaline-spiking dope after another.

But its veins are wearing thin. There are a growing number of signs that a dangerous rupture is coming.

When it happens, one of the most powerful correlations in the economic world will become one of the most potent moneymaking strategies in the market.

The Ties That Bind Us

Over the last three decades, there has been an obvious tie between stock market volatility and inflation.

For example, the last time we saw inflation running as high as it is right now was in late 2011. The annual rate of inflation was about 4% at the time.

At the same time, the VIX – the standard measure of market volatility - soared to more than 40.

The biggest spike in inflation in the last 30 years came in 2008, just before things melted down and the VIX soared to a high near 80 points.

Going back even further, to 1990, when inflation peaked at nearly 6.4%, we see the VIX soared once again – right on cue.

The ties are obvious. When prices rise… so does volatility.

But here’s the thing with that. It’s what makes the idea so obvious: The VIX is simply measuring the price of S&P 500 options. So of course when prices are rising, the price of insuring ourselves against big stock market moves surges higher.

And when prices are surging… we don’t want to be buyers.

We want to be sellers.

Inflation Buster

That’s why a covered call strategy is an ideal way to play rising inflation. It creates an ideal stream of income that should easily keep pace with rising prices.

If you’re unfamiliar with the idea, it’s pretty simple. A covered call strategy involves simply selling call options on a stock that you already own.

It generates income because you keep the proceeds derived from selling the option contract. And as volatility rises, that income stream can grow quite large since investors are willing to pay a premium for contracts because they expect prices to rise further and faster.

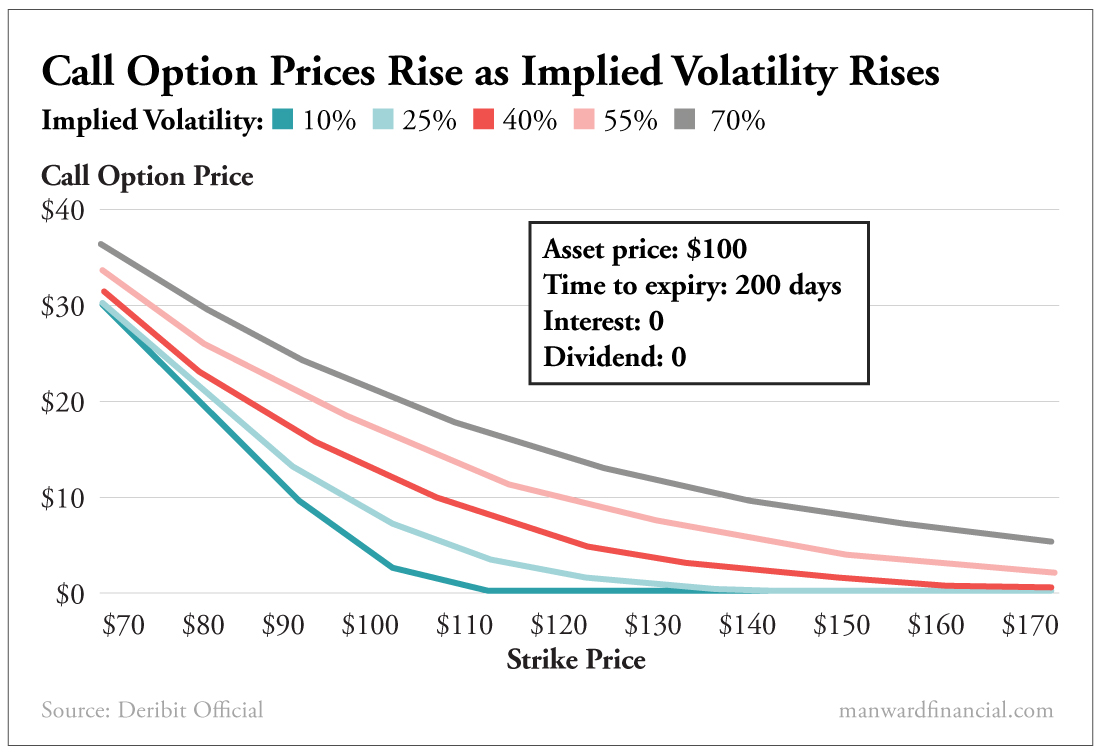

You can see it in this chart. As implied volatility rises, so does the price of call options.

The downside, of course, is that if the underlying stock rises above the strike price of the call option, you will likely have to sell it at that price.

If that happens, you take the proceeds (often at a strong profit) and move on.

It’s a popular strategy amongst active investors in any market… but it’s an ideal strategy when prices are rising.

We’re convinced Powell isn’t telling the whole story.

If he did, he’d spark the sort of inflation that would mar his career and send the nation’s economy into a nasty tailspin.

But the pressure is there. Prices are rising. And all signs say they will keep rising.

As they do, put this strategy to work.

It will treat you well.