Stocks… Gold… and Crypto? The Right Portfolio for Today’s Markets

Andy Snyder|December 23, 2020

Editor’s Note: Today, Andy continues his introduction to his new MAP theory of investing. It’s an entirely new way to think about investing… and below, you’ll see how it all fits together.

Yesterday we explained how most investment advice is based on theories that are impossibly outdated for today’s modern – and manipulated – markets.

That’s why we want to introduce you to something else – something better.

We call it “modern asset portfolio” (MAP) theory.

It is a smarter – and potentially much more lucrative – way to invest. It answers the sorts of questions we get over and over from readers whose intuition tells them the “norm” is wrong.

Questions like…

What about Bitcoin?

Where do I find income when rates are locked at zero?

Should I still own bonds if the government is buying them too?

How do options fit into all of this?

Like we said yesterday, none of those ideas were around when Markowitz won his big prize.

Clearly the thought of protecting a portfolio with options didn’t cross his mind… After all, options weren’t widely available for another two decades. But all these things do fit our MAP theory.

“Hold My Beer!” – Jay Powell

We’ve said many, many times that interest rates are the hormones of the economy. It’s not a revolutionary idea. It’s why the Federal Reserve uses them as its most powerful tool.

When rates are high… consumers tend to do one thing. When rates are low… they’re incentivized to do another.

Interest rates – and our interpretation of where they will head next – change the choices we make.

Since that’s the case, why do our most coveted investing models not include rates as a major variable?

Simple. When Markowitz penned his theory, the Federal Reserve had far less power. It didn’t hold televised press conferences, and its moves were hardly considered a driving force for the market.

It sat in the back and quietly pulled levers. Now it screams, “Hold my beer!” while it wildly mashes down the gas pedal.

Bottom line… Things have changed. Our modern markets look a whole lot different. That means our investing models must look different.

That’s why our MAP theory starts with interest rates. It has five distinct levels, all based on “real” interest rates at the time (in this case, that’s the 10-year Treasury rate minus inflation):

- Negative

- 0% to 1%

- 1% to 3%

- 3% to 5%

- Greater than 5%.

Each level calls for its own unique mix of assets.

After all, if we compare an economy that has negative real rates with one that has rates above 5%, we’d see some stark differences. Wouldn’t it make sense, then, that our investing strategy would be starkly different as well?

Amazingly, Markowitz’s theory doesn’t allow for it… nor does it allow room for correlations that adjust based on changing rates.

A Faster Way to Get Rich

Let me be very clear about MAP theory.

The assets and allocations of each level are based on the mindset and conditions of the time. After all, that’s what “modern” means.

In other words, if the masses are rushing into something new and shiny (like tech stocks or Bitcoin), we must adjust our equations accordingly.

Again, that’s the downfall with Markowitz’s model. It fails to capture the constant – and often sudden – movements of correlations.

A 50-year correlation does you no good if it breaks in the 10 years before your retirement because of a fast-moving, new (or modern) trend.

That means we can’t lay out a strict investment thesis for our “Greater than 5%” level with any sense of accuracy until we get closer to that environment – which could be many, many years from now.

To describe today what that will look like would be mere guesswork.

But – and this is critical – using interest rates gives us the catalyst to adjust our allocations and make smart, forward-looking adjustments as we transition from one level to another.

Again, Markowitz’s theory does not allow for that. With his outdated model, there’s no catalyst for looking at current correlations and comparing them with historical numbers – a deadly flaw.

Take, for example, the level that we are currently at – negative real rates.

It calls for a relatively heavy dose of non-income-producing assets, like gold and cryptocurrency.

To say Bitcoin has a “historical” correlation with stocks is nonsense. It’s too new. To say it does or doesn’t have a tie to stocks is like getting married after a first date – we wouldn’t have much of a sense for each other.

But here are some key things.

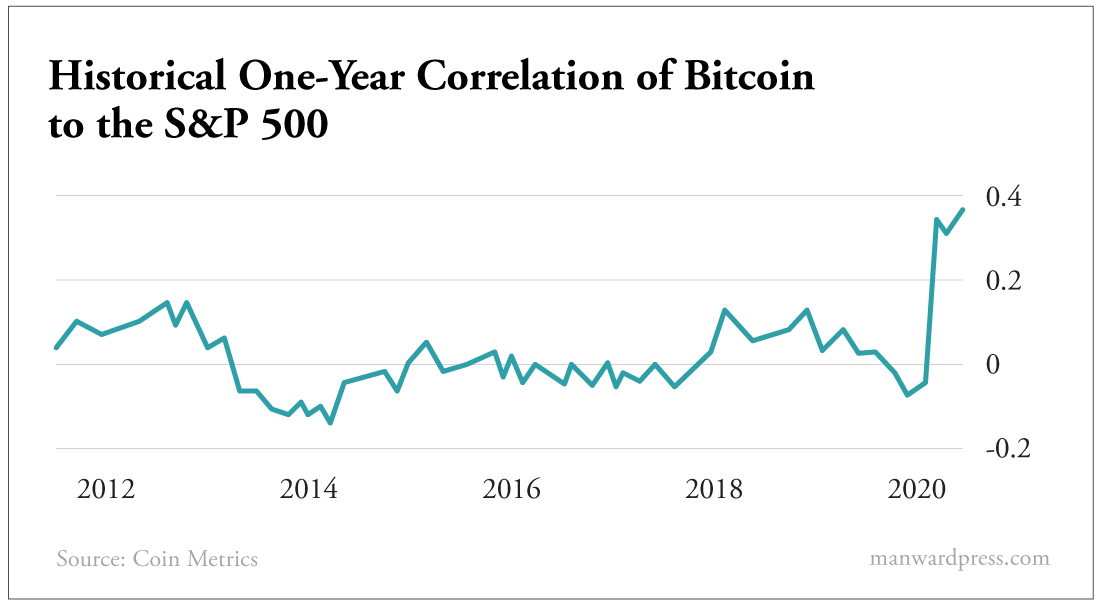

Take this chart, for instance…

It shows that Bitcoin’s correlation to the S&P has been all over the place since its creation. And it has soared to a record high this year. It won’t last. But the reason the tie got so strong will.

As the Federal Reserve slashed rates and promised us it “isn’t even thinking about thinking about raising rates,” investors ditched the idea of finding income from traditional sources and poured into speculative assets.

Tech stocks… small caps… gold… and crypto soared. They will continue to do so as long as interest rates are low and consumers are willing to speculate.

Another class of stocks has found a massive amount of buyers as rates have plunged as well… buyback stocks.

It’s our favorite realm these days for big profits.

Buybacks certainly aren’t part of Markowitz’s equation. Like options, cryptos and ETFs… they weren’t even around when he did his work. In fact, they were illegal until the Reagan administration signed off on SEC Rule 10b-18 in 1982. Prior to that, they were deemed a form of market manipulation and were off-limits.

But in an economy with negative interest rates, they’re one of the biggest drivers of stock price appreciation.

So, manipulation or not, we must own stocks of companies buying back their shares when rates are negative. We’ll sell them – hopefully at a big profit – if and when rates rise. Because, at that point, the math behind our buyback strategy won’t make sense.

That’s the key to MAP theory.

We do what makes sense right now based on the biggest driver of the modern market… interest rates. And, bigger yet, we do it with modern assets – like Bitcoin, ETFs, options and buyback stocks.

Final Words

Right now, nobody is thinking this way about portfolios. Nobody is challenging the textbooks and wondering why nothing in them makes sense in today’s markets.

A lot has changed in the last 70 years. Many of the prize-winning ideas that once dropped jaws have long been debunked. Many are even laughed at today.

Markowitz was a smart guy. His modern portfolio theory made sense back then.

But now we have a fresh set of truly modern assets and technology to add to the mix. Markowitz wasn’t wrong… but the folks who still follow his logic today are.

Let’s do something different… something better.

Editor’s Note: As Andy mentioned, a modern portfolio calls for modern assets. And right now, cryptocurrencies – the most modern of assets – are absolutely on fire… and could be the biggest story of 2021, which is why Andy has just begun offering exclusive crypto picks as part of his Alpha Money Flow trading research service. Click here to find out how to get access.

Do you have questions about Andy’s Modern Asset Portfolio? Send them to mailbag@manwardpress.com.

Andy Snyder

Andy Snyder is an American author, investor and serial entrepreneur. He cut his teeth at an esteemed financial firm with nearly $100 billion in assets under management. Andy and his ideas have been featured on Fox News, on countless radio stations, and in numerous print and online outlets. He’s been a keynote speaker and panelist at events all over the world, from four-star ballrooms to Capitol hearing rooms.