Is Tesla Out of Juice?

Amanda Heckman|April 22, 2023

Drip… drip… drip…

Uh oh.

Don’t look now, but it looks like Tesla (TSLA) is almost out of juice.

Elon Musk’s pet project had a very bad week.

While Musk remains occupied reinventing “free speech” on Twitter…

His car company is desperately in need of fix… before it blows up like one of his rockets.

In Tesla’s mixed earnings report this week, the company said it has again slashed prices on several of its vehicles.

It was the second price cut this month and the sixth on the year… all while inflation is wreaking havoc on input prices.

Investors were not pleased.

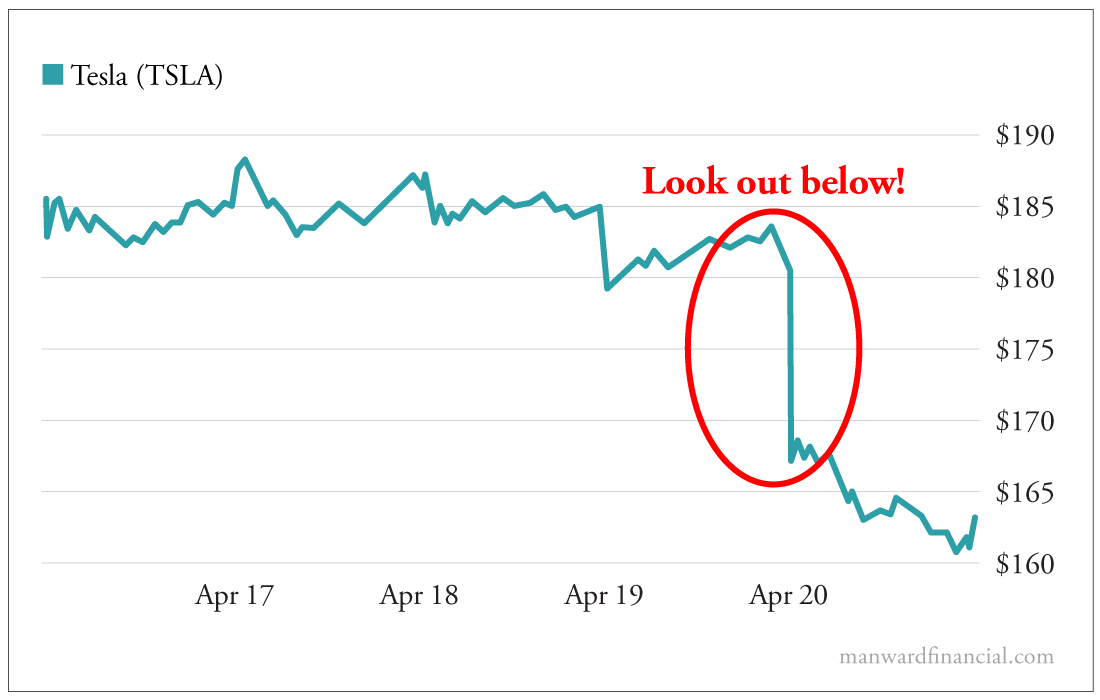

The stock fell 12% on Thursday after the news broke, with concerns mounting over the company’s profitability.

The effects of those price cuts were made clear on the earnings call…

Tesla’s quarterly profit declined to $2.5 billion from $3.3 billion in the year-ago period.

Net income fell by $700 million to $2.9 billion.

And, perhaps most telling, operating margins shrank from 19% to 11.4%… a two-year low.

Plus, the company produced more cars than it sold in the quarter, suggesting a slowdown in the once-rapid pace of demand.

While Tesla remains top dog in the EV sector… there’s a caution sign ahead.

Trouble

Growth has slowed at the company as rising interest rates have made borrowing more expensive and car loans harder to get… all while competition in the sector has heated up. More automakers are jumping into the EV race as the Biden administration and many states push for stricter rules for gas guzzlers (not to mention bribe entice drivers with incentives).

In January, Tesla vehicle registrations were up 34% year over year.

But non-Tesla EV registrations were up a stunning 186%.

And Tesla’s total market share in January dropped to 57%, compared with 74% in January 2022. Companies like Ford, Chevrolet and Volkswagen are making steady gains.

Here’s the big problem…

Musk said he’s cutting prices to boost demand… and tried to reassure investors that the payoff will come later. He’s convinced his driverless technology will bring in the big bucks soon.

He’s banking on Tesla’s software producing a strong recurring revenue stream.

Investors aren’t so sure… and aren’t waiting to find out.

Can you blame them?

Musk’s been promising fully self-driving vehicles for years (at least since his 2019 “Autonomy Day”)… but has admitted it’s turned out to be harder than he’d imagined.

Tesla is also under investigation by the U.S. Justice Department and the National Highway Traffic Safety Administration over its claims about self-driving capabilities and the safety of the technology.

Over the short term, investors would be wise to sit this one out.

Instead, they should look at the company that’s being called “Tesla’s worst nightmare.” It has incredible battery technology… best-in-class motor engineering… and is making cars with double the average electric car’s range.

It’s the No. 1 EV stock to consider owning right now… and it’s less than $10. Details here.

Amanda Heckman

Amanda Heckman is the editorial director of Manward Press. With unrivaled meticulousness, she has spent the past dozen or so years – give or take a few sabbaticals – sharpening Andy’s already razorlike wit. A classically trained musician and a skilled writer in her own right, Amanda takes an artistic approach to the complex world of investing. Her skill has led her to work with numerous bestselling authors, award-winning financial gurus and – lucky for us – the fine folks at Manward Press.