Three Reasons for Crypto’s Big Rally

Amanda Heckman|August 14, 2021

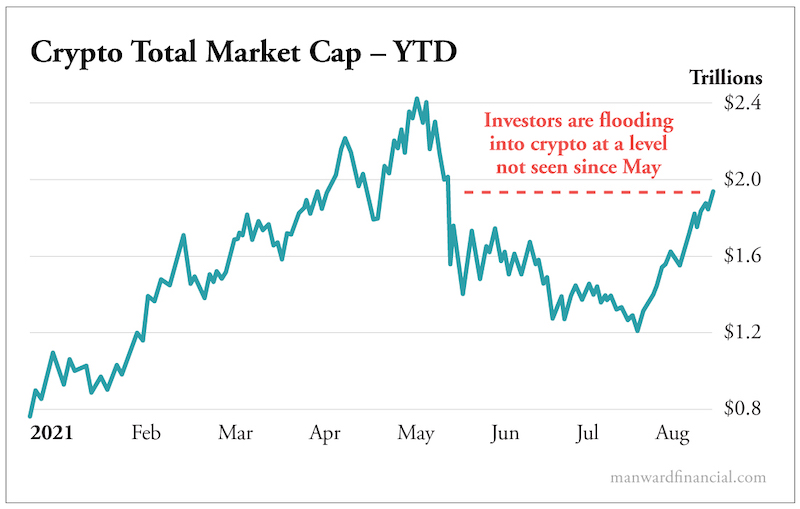

Crypto has come roaring back.

After a three-month breather, Bitcoin and Ethereum made some big gains this week – up 14% each in just a matter of days.

Bitcoin passed the $45,000 mark. Ethereum is over $3,000.

The sector’s total market cap once again rose above $2 trillion, a figure not seen since May.

And naturally… the crypto bulls have returned.

Forbes and Fortune quoted multiple analysts who predict Bitcoin will soon hit $100,000.

“It’s still got plenty of room to get the old high. And guess what? If it just follows Ethereum, it goes to $100,000,” said Mike McGlone of Bloomberg.

Why the optimism? A few reasons, it turns out. And one can simply be chalked up to “bad news is good news.”

Let’s head to Washington…

A Good Problem?

President Biden’s infrastructure bill finally saw the light of day as it passed in the Senate this week. It heads back to the House for final approval (but not until Congress comes back from its late summer break in September).

But this ain’t your grandaddy’s infrastructure bill…

Those clever Congressfolk managed to squeeze in a very un-infrastructure-like provision that taxes cryptocurrency. It raised a lot of hackles because some folks found the language surrounding who, exactly, would pay taxes on crypto too broad. But, this being Washington, the Senate passed the bill anyway and the original language stayed intact.

While that may seem like bad news for the crypto crowd… the market clearly didn’t mind. Quite the opposite, in fact. The bottom line for crypto investors is…

The U.S. government thinks it can raise $28 billion in taxes from the crypto industry in the next 10 years. And that’s a fine enough reason for Uncle Sam to keep Bitcoin and its digital descendants around.

It means crypto is here to stay.

As Jeff Bandman, a former senior official at the Commodity Futures Trading Commission, put it…

The government is going into partnership with the crypto industry. The government didn’t abolish tobacco – it taxes it. The government taxes alcohol. The government taxes capital gains and income, and all kinds of other things.

Crypto now has an official, government-sanctioned role in the U.S. economy. And we all know that once the government gets used to this tax revenue, it won’t give it up.

Better, Faster, Cleaner

Another big tailwind for crypto is the long-awaited “London fork” on the Ethereum blockchain. This software upgrade will make transaction fees more predictable… and will allow for more transactions.

The fact that the upgrade went off without a hitch sent Ethereum soaring 25%. In a decentralized system like blockchain, with lots of folks involved, you need everyone to play nice to make an upgrade like this successful.

What’s got folks most excited, though, is that the update paves the way for Ethereum 2.0. This upgrade and total overhaul of the system has been in the works for years. Soon – perhaps as early as 2022 – Ethereum will move to “proof of stake” instead of “proof of work” for verifying transactions.

Such a change will reduce the blockchain’s energy use drastically… and speed up transactions to compete with the likes of Visa… perhaps the two biggest pain points for crypto.

Bank on This

And finally, there was some exciting news about the latest in mainstream crypto adoption.

This week we learned in the latest Coinbase shareholder letter that the company has teamed up with PNC, the nation’s fifth-largest bank. The partnership will lead to some sort of crypto offering – investments or a crypto desk, for example – for PNC’s clients.

PNC remains mum on the details, but the bank has reportedly been headhunting for crypto-related positions. All signs point to crypto becoming a large part of PNC’s offerings.

PNC joins a long list… According to research by Blockdata, a blockchain market intelligence outfit, 55 out of the top 100 banks (by assets under management) have some form of exposure to crypto. This includes direct and indirect investments in crypto and decentralized ledger (blockchain) technology firms.

These new developments further cement crypto’s status as a viable technology and asset. New all-time highs are sure to come… and plenty of profits alongside them.

That’s why there’s never been a better time to learn about Andy’s top crypto plays for 2021… including a tiny coin that’s outperformed Bitcoin more than four times over.